Understanding Financial Stress

Financial stress is a real problem and 72% of Americans feel stressed about money at least some of the time according to an APA study.

Financial stress can have a wide-ranging impact on your life, affecting your mental health, physical health, relationships, and even long-term opportunities. Here are some of the main ways it shows up:

1. Mental and Emotional Health

-

Increased anxiety, worry, or panic about bills, debt, or the future.

-

Higher risk of depression or burnout.

-

Trouble sleeping because of constant money concerns.

-

Difficulty concentrating or making decisions due to stress.

2. Physical Health

-

Chronic stress can raise blood pressure and strain the heart.

-

Headaches, digestive issues, or muscle tension from stress.

-

Lowered immune system, making you more vulnerable to illness.

-

Unhealthy coping habits (overeating, drinking, smoking, avoiding exercise).

3. Relationships and Social Life

-

Strain in marriages or partnerships due to arguments about money.

-

Less time or energy for socializing, leading to isolation.

-

Tension within families—especially when providing or depending on financial support.

How can Therapy Help With Financial Stress?

While financial stress can have a negative impact with your health, therapy can help take those affects away and minimize the bad effects.

-

Therapy for financial stress focuses on addressing both financial issues and emotional support.

-

It helps you understand your relationship with money and develop healthier financial habits.

-

Financial therapists combine financial planning with psychological strategies to reduce stress and anxiety.

Stress Reduction

Money worries often carry both practical and emotional weight—budgeting concerns, debt, saving for the future, or even the shame and guilt tied to spending habits. These stressors don’t just affect your bank account; they impact your mood, relationships, sleep, and overall sense of security. Financial therapy blends financial planning with therapeutic support to help address both sides of the issue.

By working with a financial therapist, you gain tools to organize your finances and develop healthier money habits, while also exploring the emotions and thought patterns that drive financial behavior. This can reduce anxiety by creating a clearer plan for handling debt, expenses, and savings, while also lessening the emotional burden of money struggles. Over time, that balance between practical structure and emotional understanding helps many people feel calmer, more in control, and less.

Behavioral Change

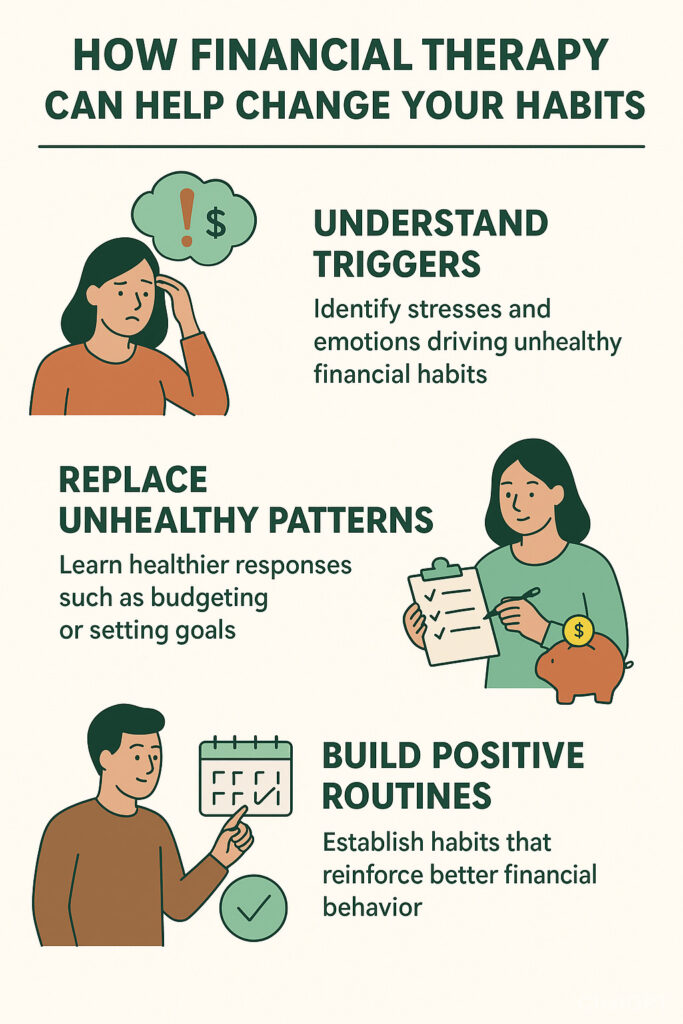

Financial therapy can improve behavior by helping you understand the deeper reasons behind your money decisions and giving you practical strategies to change them. Many financial habits—overspending, avoiding bills, living paycheck to paycheck, or even being overly restrictive with money—are linked to emotions, past experiences, and learned patterns. A financial therapist helps you uncover those influences so you can respond more intentionally instead of acting on stress, fear, or impulse.

Through guided reflection, you learn to identify triggers—like spending when you feel anxious, or shutting down when faced with debt—and replace them with healthier responses, such as budgeting, setting realistic goals, or practicing delayed gratification. Financial therapy also emphasizes building routines and accountability, which reinforce positive behavior over time.

overwhelmed by financial stress.

If you are having stress due to financial problems please give us a call and contact us for an appointment and consultation